Breaking into Finance: Why an MBA is the Key to Senior Roles in Investment Banking

Blog / December 12, 2024

Career options after MBADetails about MBA CourseMBA qualificationThe world of investment banking is synonymous with prestige, power, and myriads of financial opportunities. It is an industry prospering on intellect, strategy, and relentless ambition. Yet, the path to the upper echelons of this remunerating discipline is not for the faint-hearted. For those aspiring to secure senior roles, one credential usually surfaces as the quintessential doorway: the Master of Business Administration, aka MBA. But what makes an MBA so valuable in this high-stakes field? Well, let’s dig in!

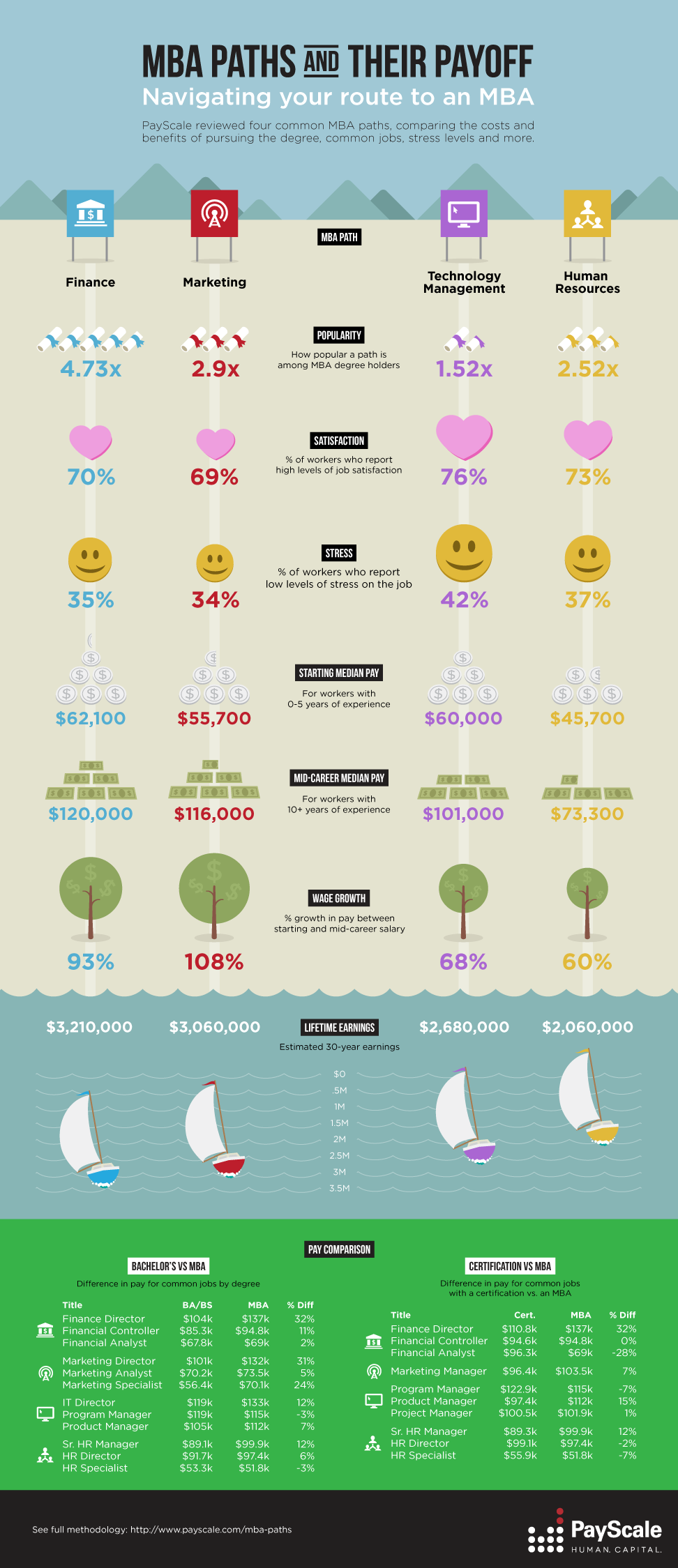

Source: https://www.payscale.com/

The Currency of Credibility

In the cut-throat investment banking corridors, credibility is key! An MBA degree from a world-class B-school is a badge of excellence, a mark that proves your intellectual rigor, strategic acumen, and ability to steer intricate financial domains.

Needless to say, prestigious “Business Schools” have long been heralded as breeding grounds for the industry’s elites, as their graduates carry not just a degree but the weight of a reputation that opens ample doors to boardrooms and trading floors globally.

Bridging the Skill Gap

While undergraduate degrees, such as BBA, B.Com, etc., often lay foundational stones of financial knowledge, senior roles demand the ascendancy of multifaceted competencies. An MBA curriculum is punctiliously crafted to fill this gap. From innovative financial modeling as well as corporate strategy to negotiation and leadership, the MBA entrusts aspiring minds with a vigorous toolkit. Additionally, electives catered to investment banking make sure that aspirants are fluent in the language of mergers, acquisitions, and capital markets.

Networking: The Lifeblood of Banking

In investment banking, who you know can be as crucial as what you know. MBA bonds forged during an MBA can make the biggest difference between landing a coveted internship at a bulge bracket organization and languishing on the sidelines. These connections usually go beyond the classroom, building a lifelong professional support system.

A Springboard for Career Transition

When it comes to exclusivity, investment baking is exceptionally notorious. For professionals without a background in finance, stepping into the field can feel like scaling a donjon. An MBA acts as a major equalizer, offering a well-structured pathway to turn into banking from diverse career trajectories. Regardless of whether you are a marketer, a consultant, or an engineer, an MBA serves as a bridge, entrusting you with immaculate skills or credibility to transition effortlessly into finance.

Accelerating Career Trajectory

In the hierarchy-driven investment banking, clinching the corporate ladder can be a long endeavor. An MBA, nevertheless, can serve as a career ameliorator. Most firms actively hunt MBA graduates for mid-level positions, surpassing the entry-level grind. With in-depth knowledge and leadership training gained through an MBA, candidates are radically fast-tracked to roles taking responsibility and massive remuneration. However, below are some potential career options available after an MBA. Keep reading to know.

- Strategy Consultant

- Business Analyst

- Operations Consultant

- Corporate Finance Manager

- Equity Research Analyst

- Brand Manager

- Digital Marketing Strategist

- Private Equity Associate

- Venture Capital Analyst

And many more!

MBA Course List and Details

An MBA provides a holistic comprehension of business and management principles. The degree spans two years and covers a broader range of topics, offering a quality education for aspiring business professionals. Below are the details of the highlights of an MBA course.

MBA Qualification

To be eligible to the MBA program, aspirants must fulfill the following criteria:

- Final-year undergraduate students may apply, and a provisional offer will be issued.

- A minimum aggregate of 50% in the Bachelor's degree or an equivalent qualification is required (final-year students can apply).

- A valid score from any of the following entrance exams: GMAT/GRE, CAT, or XAT/NMAT/GATE.

The Duration

Almost all full-time MBAs are of 2 years. However, institutions also offer full-time or part-time options, enabling flexibility for working professionals.

Achieve Leadership Excellence with an MBA @ Shiv Nadar University (Institution of Eminence)

Established in 2011 by Shiv Nadar, the founder of HCL Technologies, a private, interdisciplinary university located in Greater Noida, India, Shiv Nadar University is popularly known for offering undergraduate, postgraduate, and doctoral programs in multiple fields, including engineering, business, natural sciences, humanities, design, etc.

The university focuses on research, innovation, and entrepreneurship, with strong industry collaborations and global partnerships. Its modern campus offers top-tier infrastructure and facilities. Reckoned for its research-oriented courses and academic excellence, the university is dedicated to fostering leadership, critical thinking, and global perspectives, readying students for success in a rapidly evolving world.

Under one of its wings, the School of Management and Entrepreneurship, the university offers a Master in Business Administration (MBA), designed to hone individuals into professionals characterized by global adaptability, ethical consciousness, and compassion.

MBA Courses Available at Shiv Nadar University:

- MBA (Global)

- MBA (Executive)

- MBA (Analytics)

- MBA (Online)

The Final Word

While there is a plethora of pathways into the finance sector, the MBA stands unmatched as the key to senior roles in the field of investment banking. Simply, it is an investment in oneself, a declaration of ambition, and a commitment to excellence. On the off chance that you have a vision as well as the tenacity to be at the zenith of finance, the MBA is not just an option but a catalyst that transforms aspirations into achievements.